Risperdal, an anti-psychotic medication manufactured by Johnson & Johnson subsidiary Janssen Pharmaceutica, is the epitome of how these companies don’t give a damn about patients’ health when it threatens their profit margin.

This particular story begins in the late 1990s when Johnson & Johnson, once considered “America’s Most Trusted Brand,” expanded its Elder Care Unit by 40%. It should come as no surprise. The first “Baby Boomers” were well into their fifties, portending an increase in the elderly population – and a corresponding expansion of the market for geriatric medicines and other health care products.

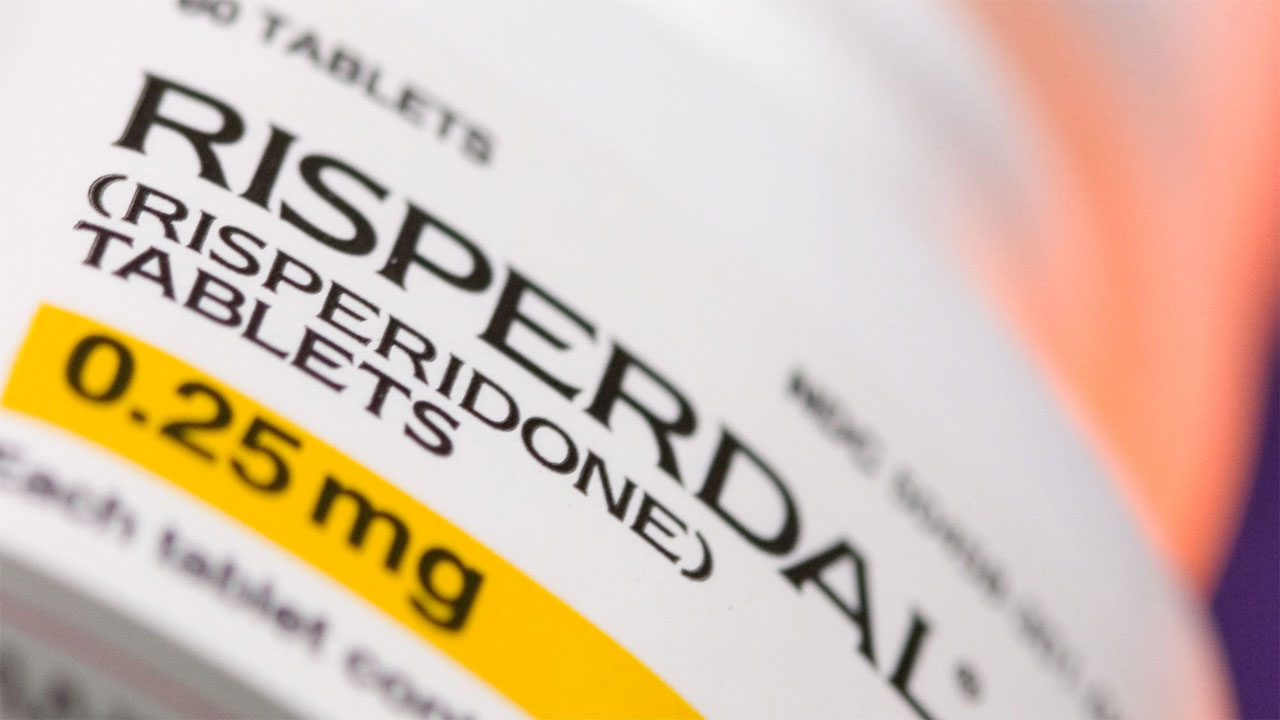

Risperdal (risperdone) was developed in the early 1990s. It was originally intended to treat mental patients suffering from schizophrenia and control mood swings associated with bipolar disorder and autism. The drug is a dopamine antagonist, meaning that it blocks dopamine receptors in the nervous system. Dopamine is a chemical neurotransmitter. Among other things, it plays a role in fine motor control. While dysfunction of the dopamine system is implicated in mental disorders such as schizophrenia, it has also been implicated in degenerative neural conditions such as Parkinson’s Disease (PD) as well as ADHD and so-called “restless legs syndrome.”

Therein lies the tale. While PD can strike at any age, the average age at onset is 60. In additional to physical symptoms (shaking, stiffness and reduced reflexes), it can also affect mood and cognitive processes. J&J began issuing sales literature to its ElderCare staff, suggesting that Risperdal was “safe and effective” in “treating hostility in the elderly.” The company also started marketing Risperdal for other “off-label” uses (prescribing the medical uses for which it was not intended or approved), including treatment of dementia. In short, if one’s aging parent is cantankerous and disagreeable, or becoming forgetful – Risperdal was the answer.

Was it effective? Somewhat. Studies suggested that Risperdal had a “slight benefit” in treating dementia. Was it safe? No. Studies also link the drug to higher risk of strokes and premature death. It was also implicated in a condition known as tardive dyskinesia,characterized by uncontrolled facial tics and spasmodic movements in the limbs. For that reason, such off-label use was not approved by the FDA.

That didn’t stop J&J’s marketing department. In violation of FDA regulations, J&J and its Janssen subsidiary began “disseminating materials that imply, without adequate substantiation, that Risperdal is safe and effective in specifically treating hostility in the elderly.” This was according to a letter written to J&J in January 1999 by Lisa Stockbridge, head of the FDA’s Division of Drug Marketing. The letter went on to point out:

There is limited data on the use of Risperdal in the elderly, and the elderly population was not specifically studied in the clinical trials for Risperdal. Thus, presentations that focus on this population are misleading . . . .

Such niggling little details never bothered the pharmaceutical industry, however. Now, to be fair, Janssen did include warnings about Risperdal’s potential side effects. However, these were greatly downplayed on the label:

the risk information appears in pale and tiny font at the bottom or back of a journal ad or other presentation, or after the closing of a letter. Thus, the information is not presented with a prominence and readability that is reasonably comparable to the presentation of efficacy information.

Despite repeated warnings from the FDA, J&J and Janssen continued to aggressively market the prescription not only to seniors, but children as well – again, in violation of FDA regulations. Salespeople were motivated to promote off-label uses of Risperdal with generous bonuses – despite clear evidence that Risperdal could result in hormonal dysfunction in boys, causing a condition known as gynomastia (male breasts).

It didn’t matter. Janssen was focused on squeezing out every cent of profit from Risperdal. The company went so far as to hire “biostitutes” in the medical profession in order to help their marketing efforts. One of them was prominent pediatric psychiatrist Joseph Biederman, who spent over ten years developing a theory that ADD and ADHD were caused by “chemical imbalances” in the brain – and thus could be treated with neuroleptic and anti-psychotic meds like Risperdal.

Eventually, the entire affair ended in 2012, when Janssen was finally investigated for violating FDA regulations. Ultimately, Janssen and its parent company wound up paying out $327 million in fines for unlawful off-label marketing of Risperdal.

Now, let’s crunch the numbers, according to J&J’s own budget figures.

Projected sales of Risperdal for 2000 alone: 452 million doses at $2.50 a pop. That comes to $1.13 billion in sales. Cost of the drug for J&J: a mere .06¢ per dose. Company’s gross profit: $1.1 billion. Marketing and projected overhead costs: $103 million. Net profit: $997 million. Subtract the $327 million in fines, and J&J still cleared $670 million – and that fine was written off on the corporation’s taxes as a “business expense.”

That’s all it was to this “Corporate Person” – nothing more than the cost of doing business. Johnson & Johnson and Janssen Pharmaceutica violated the law and destroyed countless lives, yet received little more than a wrist slap.

This is what America’s profit-driven health care industry has brought us. Human life is expendable in order to maximize profits and keep the shareholders happy. It’s also another insight into the corporate mentality: if there is a problem with a product, first determine how much liability is involved. Next, compare that potential liability to potential profits. If maximizing profits to the tune of hundreds of millions of dollars means paying out a few million in judgments and settlements, well – it’s just part of the cost of doing business.